Navigating the Compliance Maze: How ERPNext Simplifies Business in India

India's vibrant and dynamic business landscape offers immense opportunities, but it also comes with a complex web of regulatory compliance. From Goods and Services Tax (GST) to Tax Deducted at Source (TDS), and from strict payroll regulations to digital mandates like e-invoicing, businesses operating in India face a constant challenge to stay compliant.

Failing to do so can lead to hefty fines, legal troubles, and a damaged reputation.

So, how can businesses, especially SMEs, keep pace without drowning in paperwork and endless audits? The answer often lies in robust ERP software like ERPNext.

The Indian Compliance Challenge: A Snapshot

- GST: Requires accurate invoicing, ITC management, and return filings.

- TDS: Deduction and remittance of taxes for various payments, with quarterly filings.

- Payroll Compliance: PF, ESI, and tax-deducted payslips.

- E-invoicing: Mandatory IRP registration with QR codes.

- E-way Bill: Required for goods movement above specified limits.

- Financial Reporting: Ind AS compliant reporting and audit readiness.

ERPNext: Your Navigator Through the Compliance Labyrinth

ERPNext’s modular structure helps businesses integrate key compliance workflows seamlessly, reducing manual work and errors.

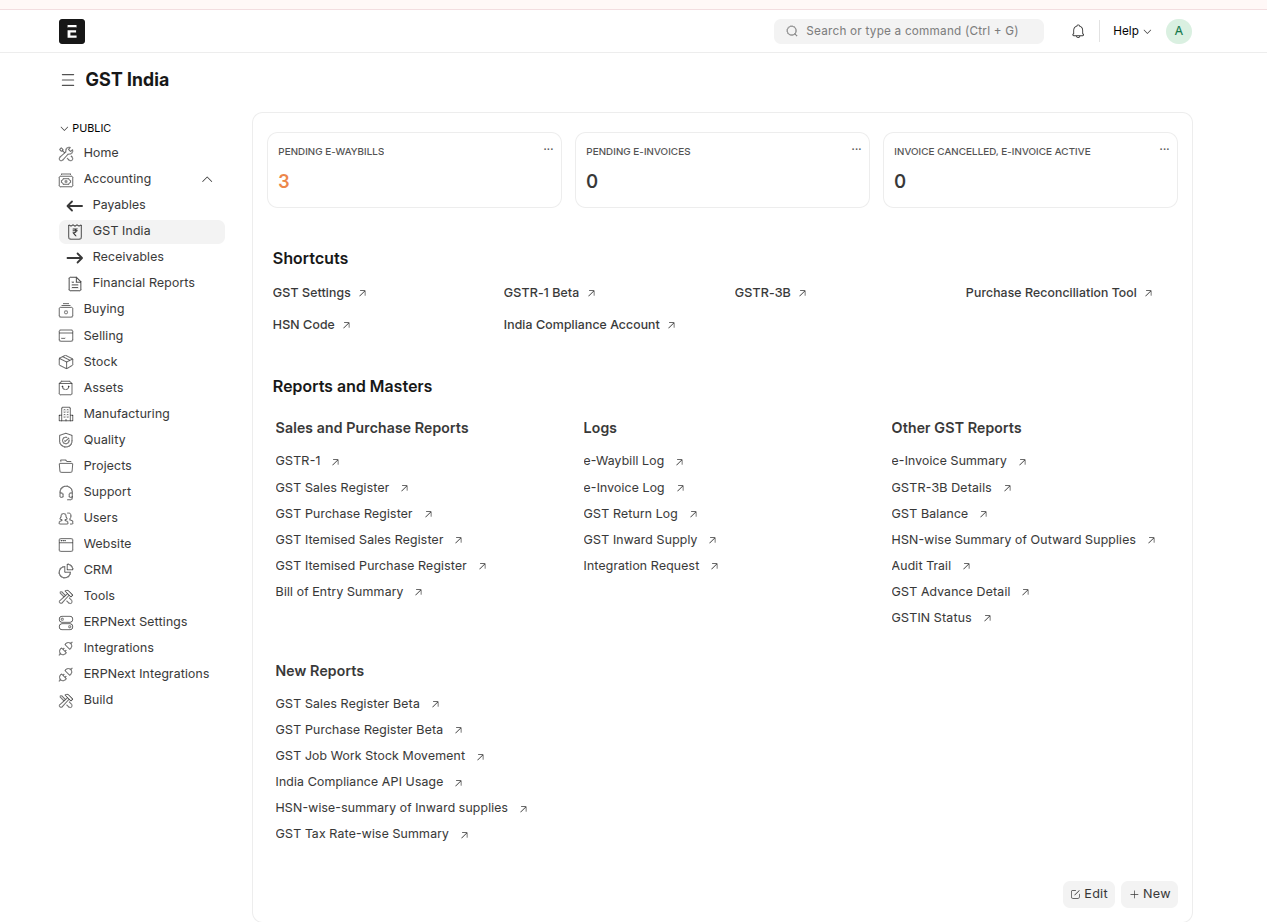

ERPNext Compliance Modules

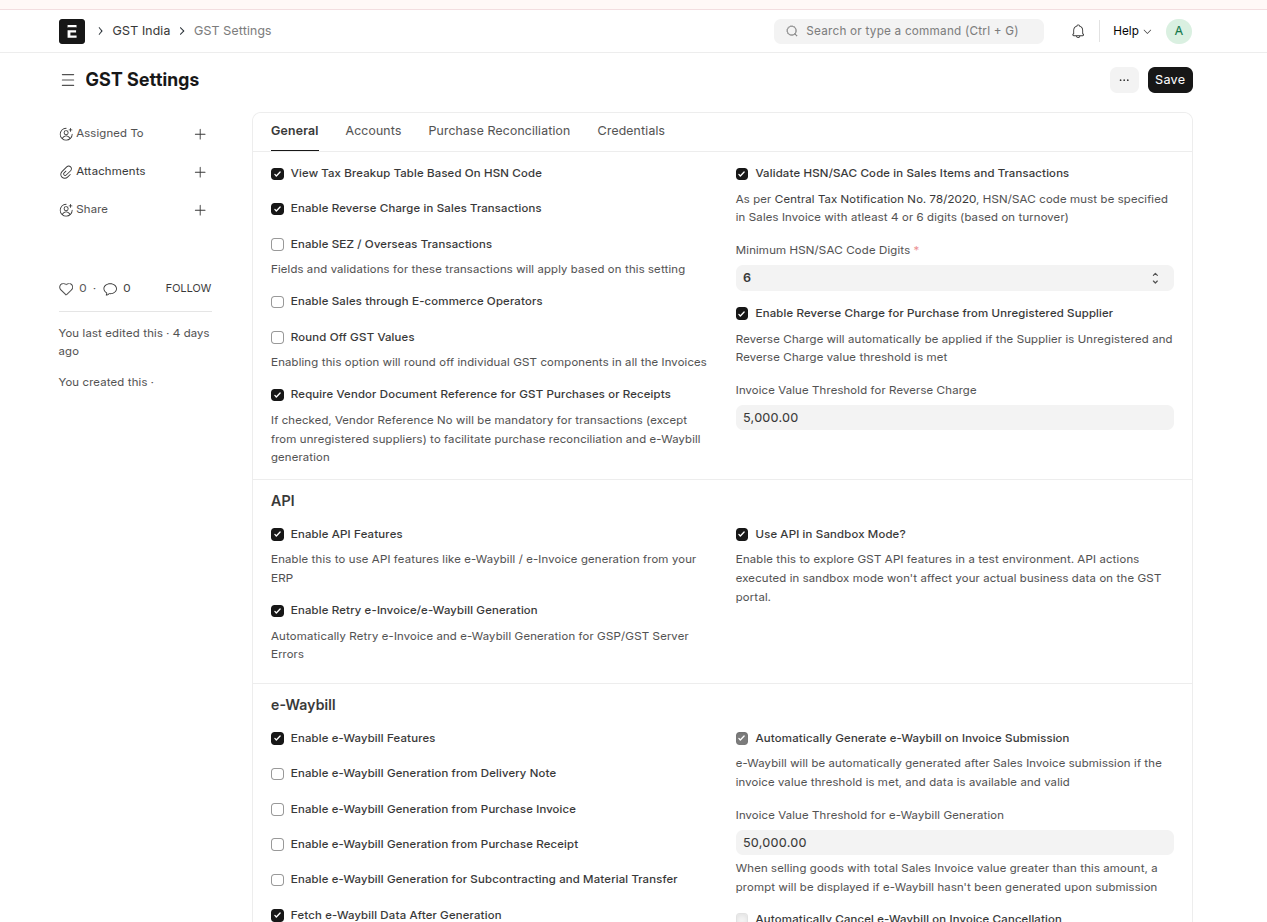

- GST Management: Automated GST invoicing, tax calculations, and return reports.

- TDS Module: Configurable TDS deductions, certificate generation, and reporting.

- E-invoicing Integration: Generation of IRN and QR codes linked with government portals.

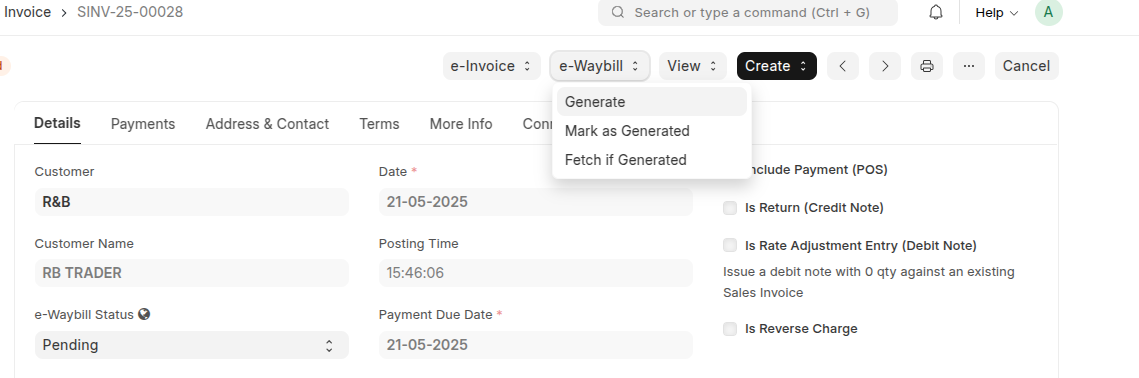

- E-way Bill Integration: Compliance for goods transport with automated waybill creation.

- Financial Accounting: Audit-ready ledgers, financial statements, and statutory reports.

- Compliance Dashboard: Real-time overview of tax filings, payroll status, and return due dates.

Seamless GST Management

- Auto-calculates IGST, CGST, SGST based on templates

- GST-ready invoices and credit notes

- Input Tax Credit tracking and reporting

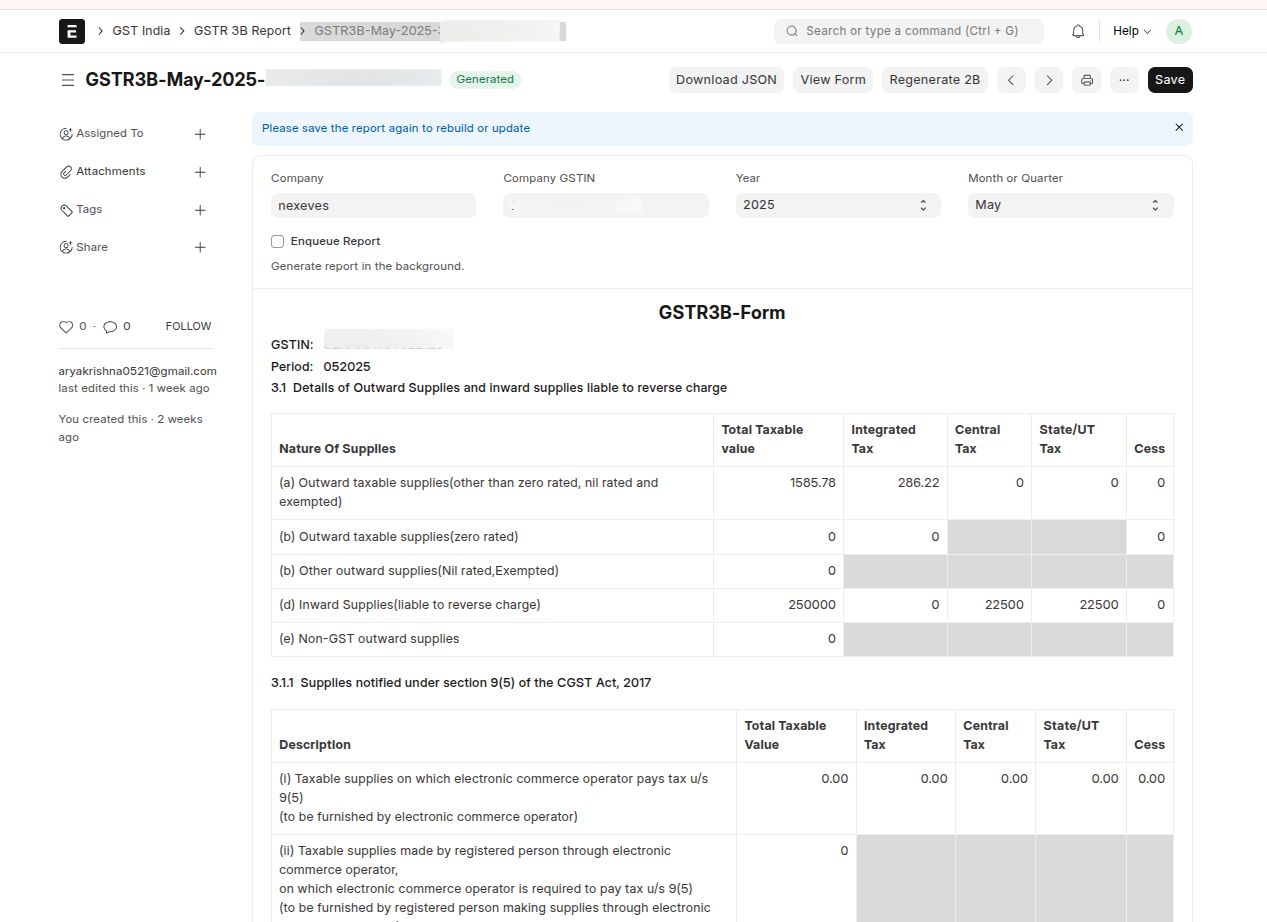

- GSTR-1, GSTR-3B report generation

Robust TDS Functionality

- Automatic deduction for applicable transactions

- Generate Form 16A/16B

- Centralized TDS reports

E-invoicing & E-way Bill Integration

ERPNext supports integration with Invoice Registration Portals and E-way bill systems for real-time compliance.

The Benefits Beyond Compliance

- Reduce manual errors

- Save time on compliance processes

- Ensure data consistency

- Make better decisions with real-time data

- Scale effortlessly as you grow

- Lower costs with an open-source solution

Conclusion: Empowering Your Indian Business

ERPNext enables you to simplify India’s complex compliance requirements. At NEXEVES, we help implement and customize ERPNext to suit your regulatory needs. Let us help you transform compliance from a burden to a business advantage.

Contact NEXEVES to begin your ERPNext compliance journey today.

No comments yet. Login to start a new discussion Start a new discussion