When a supplier sells goods or services through an e-commerce operator, they must report these transactions under Table 14 of GSTR-1, in addition to regular B2B/B2C entries.

- Section 52: E-commerce operator collects TCS (e.g., Amazon, Flipkart).

- Section 9(5): E-commerce operator pays GST (e.g., Uber, Swiggy).

Recording Transactions in ERPNext

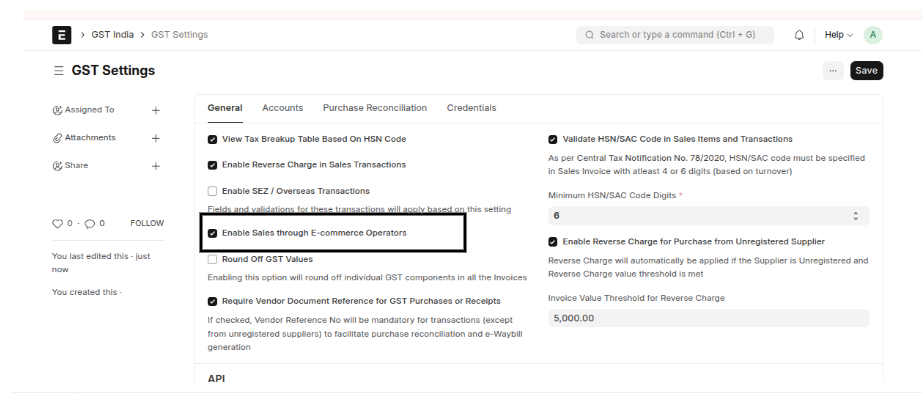

Enable the option "Enable Sales through E-commerce Operators" in the GST Settings.

Create Transaction

Sales Transactions can be created using the standard workflow.

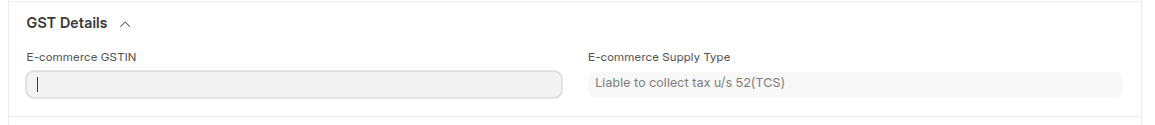

While entering the transaction, make sure to select the E-commerce Operator under the GST Details section. Based on the applicability of reverse charge, the E-commerce Supply Type will be auto-populated.

E-commerce Supply Type can be one of

-

Liable to collect tax u/s 52 (TCS)

Applicable when the E-commerce operator is required to collect Tax Collected at Source (TCS). -

Liable to pay tax u/s 9(5)

Applicable when the E-commerce operator is responsible for paying tax on behalf of the supplier (reverse charge mechanism).

E-invoicing Implications

Generally, the e-commerce operator generates the e-invoice for such transactions, so you may not be required to do so separately in ERPNext.

Reporting in GSTR-1

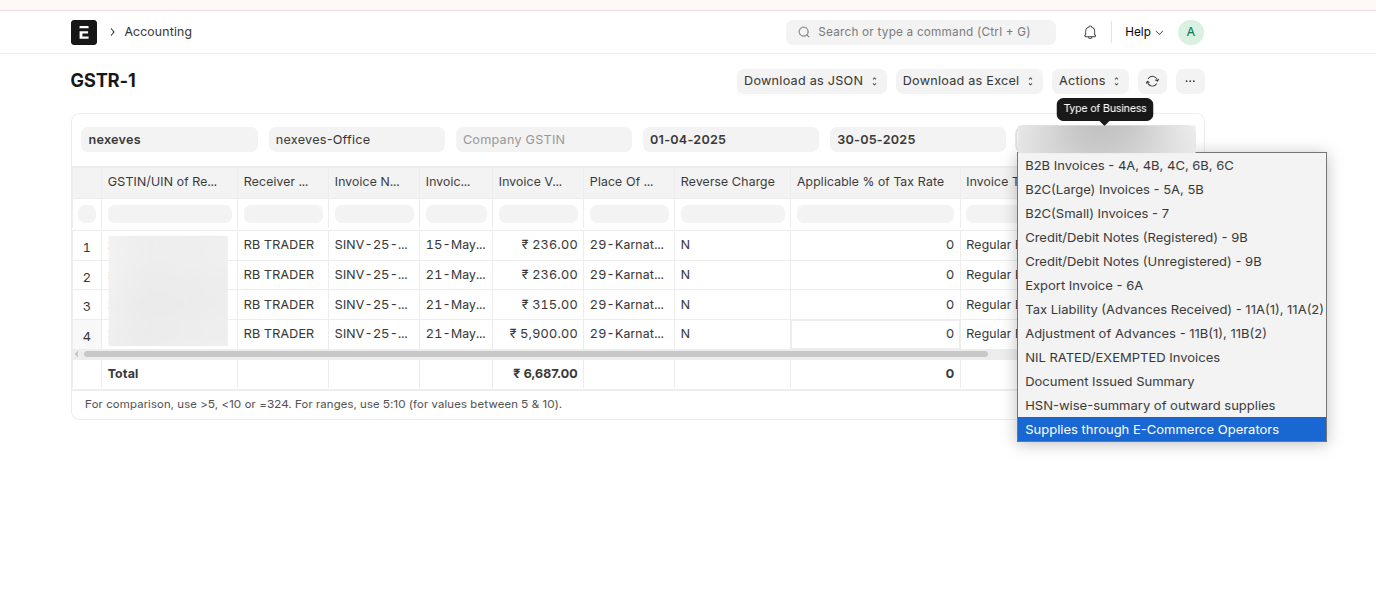

In ERPNext, go to the GSTR-1 Report and select the option “Supplies through E-commerce Operators” to view and export relevant transactions.

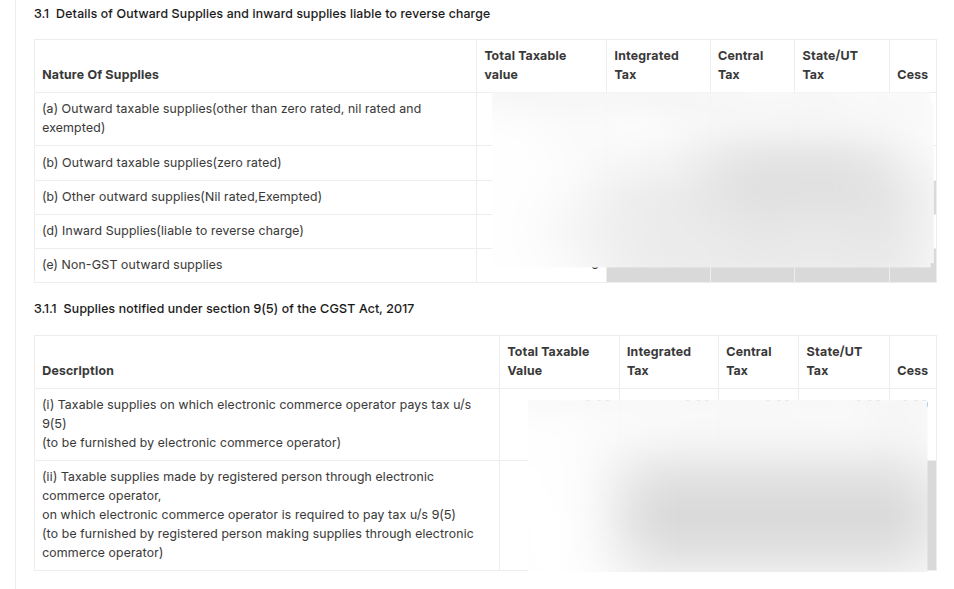

Reporting in GSTR-3B

For supplies under Section 9(5), report them under 3.1.1 - Supplies under 9(5). All other outward supplies go under 3.1 as usual.

Need help with GST compliance in ERPNext? Contact NEXEVES to simplify your compliance journey.

No comments yet. Login to start a new discussion Start a new discussion